WKU Regional Campus News

Simple Steps on How to Complete a FAFSA

- Ivana Hardcastle, Manager of Counseling & Outreach – WKU Department of Student Financial Assistance

- Friday, September 1st, 2017

One of the most popular questions that our office fields each year from students and parents is “How do we apply for financial aid and how can we qualify for student loans?” Even though the answer we give is simple—“Complete a Free Application for Federal Student Aid (FAFSA) online at www.fafsa.gov”—the process behind it can be intimidating for a student attempting this for the first time.

Below are a few simple steps that help break down the FAFSA process:

Step #1

Each person who accesses www.fafsa.gov will log in and set up his/her own individual FSA ID. The FSA ID is unique to each person.

If it is your first time filling out the FAFSA, it will take about 1-3 days for your new FSA ID to be ready to use. To register for your own FSA ID start here.

Step #2

When you have received confirmation via email from the Federal Government that your FSA ID is ready to use, you are all set to log in to www.fafsa.gov to start your application.

Each year, the FAFSA opens on October 1 and will require that you input tax information from two years prior. For example, the 18/19 FAFSA will ask that you report 2016 tax information.

We always recommend filling out your FAFSA as early as possible as many need-based programs are offered on a first-come, first-served basis. This means that funds for certain programs can run out. If you apply too late, you may not get the monies for which you would have qualified.

Step #3

Tackling the FAFSA is easiest if you break it down into small steps. First and foremost, you must select which aid year you are choosing to apply for aid. Be sure you complete the proper aid year FAFSA that coincides with the dates that you are attending college. There will be charts available on www.studentaid.gov that can assist you in making this determination.

Your school’s financial aid department can also give you insight about which FAFSA you should complete. In some cases, you might need to complete two FAFSA’s if you plan on attending school starting in the Summer (which ends each academic year) and transitioning into the Fall (which begins each academic year).

Step #4

Enter in your “Student Demographic Information.” This section should be easy, because it includes basic information about yourself.

Step #5

The “School Selection” is where you select the school(s) that you are considering to attend. Each school you select will be able to view your FAFSA information and process aid for you should you choose to attend that particular school. You can choose up to 10 schools to receive your FAFSA information.

Step #6

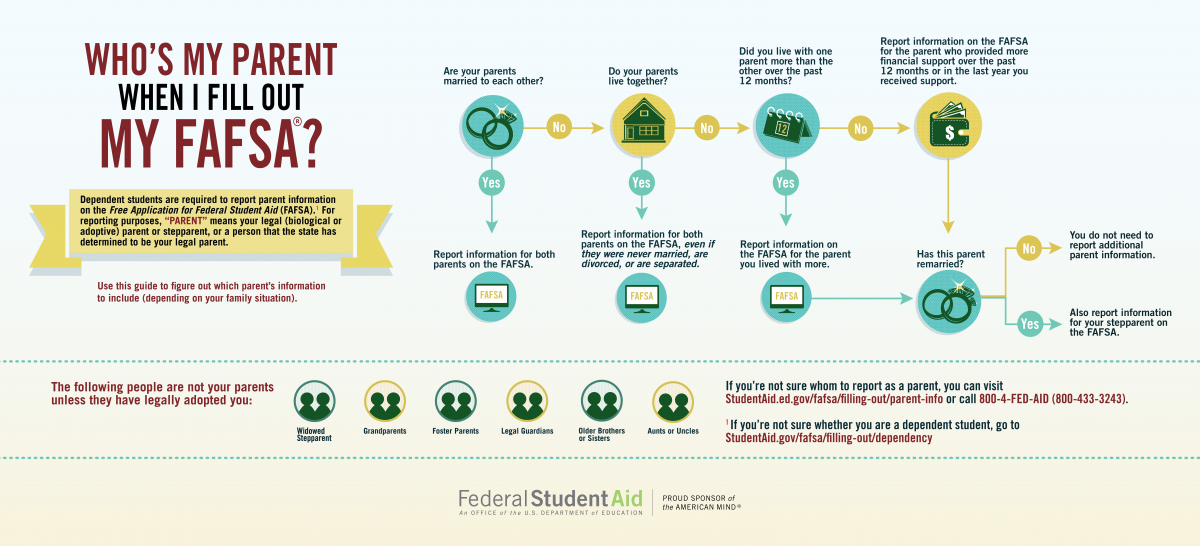

The “Dependency Status” is the part of the FAFSA where you will be asked a series of questions that will determine if you need to place your parent’s information on the FAFSA. It is important to answer these questions carefully, since this part of the FAFSA is commonly answered incorrectly. If you are not sure that you have answered a question correctly, then you may consult legal documents you might have regarding your situation. If it is determined through these questions that you are Independent then Step 7—entering parent information—will not be necessary. If you are determined to be Dependent, then you will move on to Step 7.

Step #7

The “Parent Demographics” section is where your parents will provide basic information about themselves. Don’t forget that even if you don’t live with your parents, you still must report information about them if you are determined to be Dependent in Step 6. In some cases, students come from households where divorce and re-marriages have occurred or where their parents might be separated by law but still living in the same household temporarily. If you need help determining who your parent is when filling out the FAFSA, you can follow this flow chart to make that decision.

Step #8

As the title of “Financial Information” section eludes to, this is the part of the FAFSA where you will enter financial information for your family. Before you start this step, make sure to have your tax records handy. In doing so, it will be easier to find the correct information in order to calculate the amount of financial aid for which you are eligible. Best of all, since the 18/19 FAFSA requires 2016 tax information, you will already have this information – saving you time.

Step #9

You are almost to the FAFSA finish line, but don’t quit before you complete this last and certainly most important step. You must “Sign & Submit” your FAFSA. The fastest way for you and your parent to sign your FAFSA is by submitting your signatures online.

Once your FAFSA has been successfully signed and submitted you will get a confirmation email from the Federal Government.

Shortly after you submit your FAFSA, you will get a Student Aid Report (SAR) within three days to three weeks. The Student Aid Report will be available online and will include other helpful information. We encourage all students to take a few minutes to look it over and be sure that you didn’t make any errors when logging your information on the FAFSA. If you find errors, simply log back in to www.fafsa.govand process a correction to update information as needed.

If you follow these nine steps, you will be well on your way to learning about the types of financial aid, including grants and loans, you might qualify for from both your State and Federal Governments. Spending a few minutes to file the FAFSA early in October will be worth valuable college dollars later when your school bill is due.

Most financial aid offices are not able to complete the FAFSA for or with students. At WKU, the Department of Student Financial Assistance is typically limited to aid processing only. However, if you have questions regarding your financial aid package after your FAFSA has been processed, feel free to reach out to our department at (270) 745-2755 or send us an email at fa.help@wku.edu.

If you are still uneasy about completing the FAFSA on your own, WKU has a resource to help. The Educational Opportunity Center (EOC) can help students to complete the FAFSA or make necessary updates to an already completed form. If you need additional help, feel free to reach out to the EOC at (270) 745-4441.

The content for this post is provided by the WKU Department of Student Financial Assistance. Our staff is dedicated to helping students and parents secure resources to help pay for a college education at WKU. We strive to provide the highest level of customer service possible, and the staff in the department are held to the highest ethical standards. If you have any questions, we can be reached via phone at (270) 745-2755 or via email at fa.help@wku.edu. We also have additional financial aid resources at www.wku.edu/financialaid.

More than 20,000 students grace WKU’s four campus locations in Bowling Green, Elizabethtown-Fort Knox, Glasgow, and Owensboro. For more than 50 years, WKU has offered courses beyond the Bowling Green campus at regional locations. WKU serves students at three regional campuses in Elizabethtown-Fort Knox, Glasgow and Owensboro. Two of the principal goals for WKU’s Regional Campuses are to provide access to higher education and to improve the quality of life in the communities they serve.

Some of the links on this page may require additional software to view.